Saudi Arabia continues to use the ongoing market turmoil to its advantage.

Saudi Arabia was one of the fastest growing economies in 2022 breaking the GDP $1 trillion dollars record. According to Saudi’s statistics the Kingdom’s economy rose at 8,7% in 2022, faster than any G7 or G20 countries. Oil and gas activities remained the biggest sector contributing to 33% of GDP, while government services followed at 14.2%. Saudi Aramco, the Kingdom controlled oil company, registered a profit of USD 48.4 billion (up 90% from 2021) for the second quarter of 2022. Bloomberg reported that this was “the biggest quarterly adjusted profit of any listed company.”

This stellar performance is due to high energy prices kept high by tight supply, the war in Ukraine, and by unruly post Covid market adjustment. Saudi’s fast GDP growth is also due to the country’s aggressive economic diversification away from hydrocarbons.

The energy crisis

Saudi Arabia is a net beneficiary of the market turmoil, and as pointed out by Fatih Birol, Executive Director of the International Energy Agency (IEA) during the 2023 Davos Economic Forum, “we are in the middle of the first global energy crisis”. This crisis is compounded by the war in Ukraine, leading to more energy and food insecurity, and more pressure to transition to a “Net Zero Future”. How we solve these challenges is critical for the wellbeing of the global economy.

There are cracks in the financial system

The recent banking stress, which in March 2023 brought to its knees Silicon Valley Bank, Signature Bank, and Credit Suisse, signal that a financial collapse is still possible. These banking failures led to several oil price outlook downgrades. Goldman Sachs now projects Brent prices to peak at $94 per barrel in 2023, and to stay at around the same price in 2024. Previous analysis including Bank of America projected Brent prices at $100 or above in 2023 and 2024. The truth is, that many of the analysts have not been able to anticipate any of the recent crisis, which leads me to believe that based on economic fundamentals and tight oil supply, Oil will bounce back to $100 per barrel by mid 2023. This is mostly due to the projected oil demand increase of 2.5 million barrels per day year on year. Saudi Aramco forecasts that total consumption will reach a record 102 million barrels a day by the end of 2023. This is expected because of rapid increase in air traffic, a better-than-expected economic rebound in Europe, and a robust return of the Chinese consumer demand.

What does this mean for Saudi Arabia?

As Saudi Arabia attended the OPEC meeting of April 3 rd , a further cut was announced causing Brent crude, the global benchmark, to rise by 5.31% to $84.13 a barrel. The Kingdom essentially will stay the course and continue leveraging its abundant oil reserve to influence market trends keeping supply tight. OPEC+ which accounts for 40% of all the world's crude oil output is likely to reaffirm the block commitment (reached back in October 2022) to take as many as 2 million barrels out of the market per day until the end of 2023. This is strongly backed by Russia which just announced that it will cut an additional 500,000 barrels per day, and Iraq by 211,000 (BBC). The UAE, Kuwait, Algeria, and Oman have also committed to new cuts.

An assertive Saudi Arabia

The assertiveness of Saudi Leadership and its Sovereign Wealth Fund, PIF during this time of market turmoil (the $620 billion Sovereign Wealth Fund) is greatly influenced by the overall global economic instability and oil windfall deriving from high energy prices and its derivatives byproducts. Crude oil has consistently been above $90 a barrel (except for the February and March 2023 correction) since President Putin ordered Russia invasion of Ukraine in February of 2022. As mentioned, I anticipate crude oil getting back to the $ 90-110 per barrel range by Q3 of 2023 and stay around this price over the next 2 years given fragile political systems, the oil production bottlenecks as well as the global economic recovery. In terms of revenues, Saudi Arabia is likely to add more than $300 billion in energy revenues by the end of 2023. In 2022, Saudi oil revenues hit $326 billion. This will help KSA acquire foreign assets, execute on its ambitious smart cities’ projects such as Neom and Quiddiya, and continue to diversify its economy.

What to expect next?

The oil price surge will make the battle to bring down global inflation harder. With the ongoing fragile market and geopolitical instability, the Kingdom will use its financial power to promote its foreign policy interests and leverage PIF finances to acquire technologies, invest in blue and green Hydrogen, as well as its tourist and sport infrastructure. Oil and petroleum derivative revenues will continue to be the name of the game and we should all expect PIF and Saudi Aramco to play a leading role ensuring that this economic crisis is used to the Saudis advantage.

Articles from Andrea Zanon

View blog

The world of football is witnessing a surge in international investment, with North America and the ...

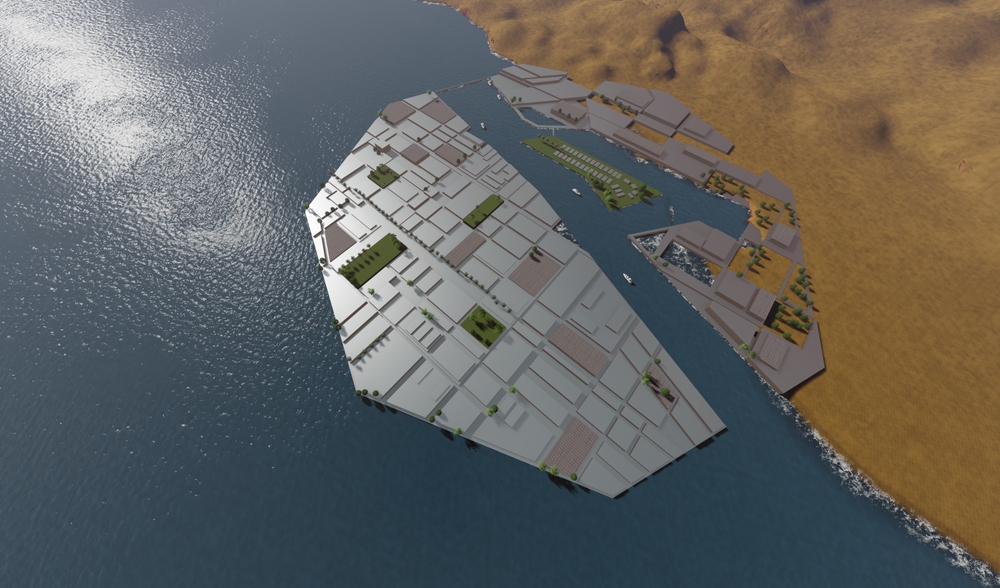

Caratteristiche, obiettivi ed impatto economico · Nel Canale di Suez sorge Oxagon, una futuristica c ...

It is well known that Saudi Arabia's Public Investment Fund (PIF) aims to become a 1 trillion-dollar ...

You may be interested in these jobs

-

Advanced Management Candidate

Found in: beBee S2 US - 3 weeks ago

Cintas Cincinnati, United States Paid WorkRequisition Number: 170121 · Job Description · Cintas is seeking an Advanced Management Candidate to be trained and prepped for Senior Leadership roles. Each assignment prior to the role of General Manager will be hands-on and designed to teach the fundamentals of that particular ...

-

Radiologic Technologist

Found in: One Red Cent US C2 - 2 days ago

Emerson Hospital Concord, United States Part timeRadiologic Technologist - Part Time 24 Hours $3,000 Sign on Bonus · Job Ref: 29093 · Category: Radiology & Imaging · Location: · Emerson Hospital, · 133 Old Road to Nine Acre Corner, · Concord, · MA 01742 · Department: Diagnostic Radiology · Schedule: Part Time · Shift: Day sh ...

-

Broward Addiction Recovery Center Full-Time pharmacy Technician

Found in: Indeed US C2 - 1 day ago

Advanced Pharmaceutical Consultants, Inc Coral Springs, United States Full timeAdvanced Pharmaceutical Consultants, Inc is a pharmacy management company that specializes in behavioral health and drug treatment centers by providing pharmacists, technicians, automation as well as expertise. We are currently seeking a licensed, experienced, hospital trained Ph ...

Comments