“How USA’s Dodd-Frank was changed to steal your money” and the Move to do so is Global.

I first wrote an article on Dodd-Frank last year. It was a cursory piece to let people know that when they deposit their cash in a bank, they give up that possession.

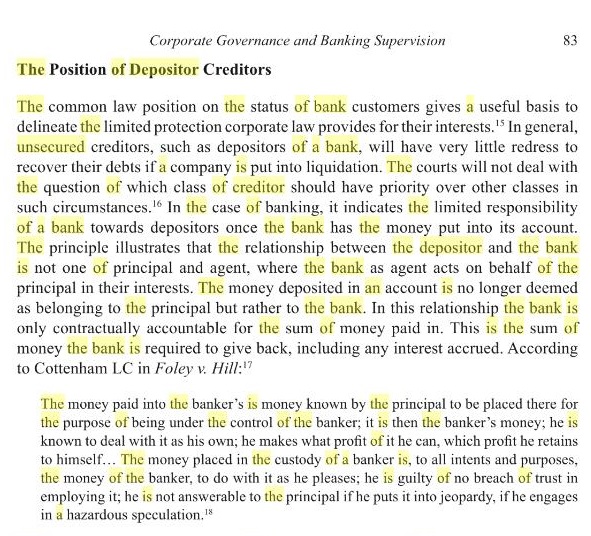

Depositors become ‘unsecured creditors’ and banks become the owners of your cash.

Reproduction of that short piece is below. Why revisit this now? I’ve been warning friends and family a bail-in will be triggered sooner or later. A video has emerged warning us that a bail-in may be happening soon. Watch it after reading:

How Dodd Frank Was Changed to Steal Your Money

Dodd-Frank was put into force after the 2007/2008 banking crisis. The original intent was to keep banks from becoming too big to fail. [Many of us can see how well that worked—I mean the big part…]

The article below gives you some history, but it doesn’t tell the whole story.

How The Dodd-Frank Act Protects Your Money

.

As with many laws, industry pokes and pokes our legislators to tweak laws to benefit them. Government has thrown off the robe of responsibility and thrown us to the wolves once again.

Dodd-Frank has been changed to provide for “Bail-ins” rather than “Bail-outs.” What that means is that when you, the bread-winner, deposit your hard-earned cash or paycheck in a bank, it no longer belongs to you. You become the unsecured creditor and the bank now owns your income.

See the article below:

.

![aE Se SE]

RET

ciao ion 1011001)

ALTURTT](https://contents.bebee.com/users/id/12949473/article/how-usa-s-dodd-frank-ael7X9AmrVaT/mAZ7Z.jpeg)

“Ellen Brown, Contributor

Ellen Brown is an attorney, Founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt.

It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors

04/03/2013 11:11 am ET Updated Jun 03, 2013

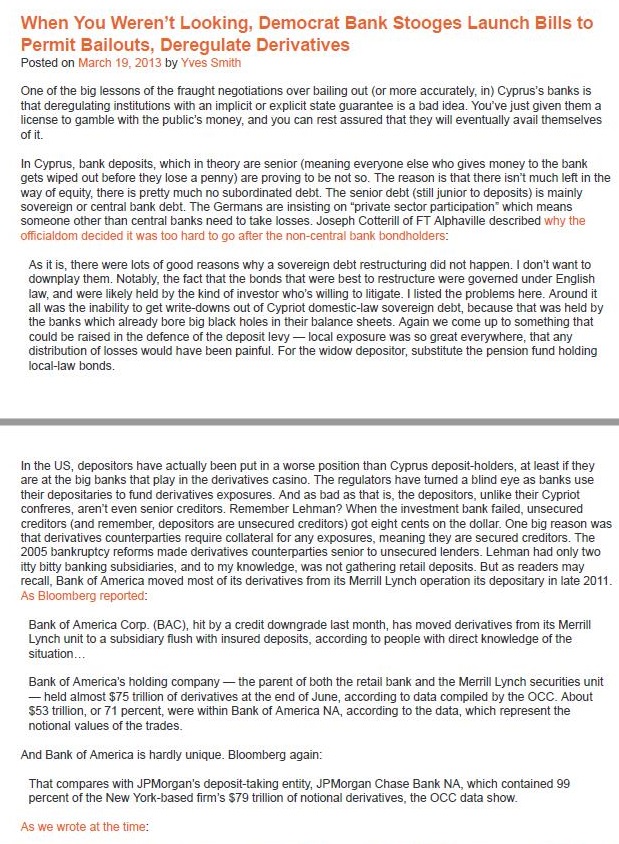

Confiscating the customer deposits in Cyprus banks, it seems, was not a one-off, desperate idea of a few eurozone troika officials scrambling to salvage their balance sheets. A joint paper by the U.S. Federal Deposit Insurance Corporation (FDIC) and the Bank of England dated December 10, 2012, shows that these plans have been long in the making; that they originated with the G20 Financial Stability Board in Basel, Switzerland (discussed earlier here); and that the result will be to deliver clear title to the banks of depositor funds. New Zealand has a similar directive, discussed earlier here.

Few depositors realize that legally, the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs. (See here and here.) But until now, the bank has been obligated to pay the money back as cash on demand. Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” The bank will get the money and we will get stock in the bank. With any luck we may be able to sell the stock to someone else, but when and at what price? Most people keep a deposit account so they can have ready cash to pay the bills.”

.

Wages have plummeted in past decades. It’s hard for many to make ends meet. Just imagine going for groceries to feed your kids and having your card declined so a bank you trusted can try to save itself from its bad decisions.

.

Michael Lazar, Contributor

Contributor, NowItCounts.com The Destination For Americans 50+

Too Big To Fail Banks Can Keep Your Money If They Fail

03/25/2016 10:13 am ET Updated Dec 06, 2017

Can too big to fail banks really take your money if things go sour and leave you screwed without access to your cash?

The short answer: without the proper regulation in place (which is currently not in place), is: YES.

A bank rescue scheme that led to one man killing himself after losing over $100,000 is already testament to it. In his suicide note, the man explained that after being a customer of the bank for 50 years, and investing in bank-issued bonds, he was relieved of his investments thanks to a hidden clause that saw him and 130,000 shareholders and bondholders left hung out to dry so the bank could stay afloat.

The bank in question was already in rescue mode, and in order to tap into a specially created rescue fund, it had to meet the requirements of the wealthier banks that would be providing the funds. However, before these funds can be accessed, the bonds are first tapped, at the loss of any said bond or shareholder.

BBC explained this method as a “bail-in.” In plain English, that means that bondholders got screwed because the bank they trusted failed. Newer EU laws basically say that losses must be forced on bondholders and depositors who have more than €100,000 on tap.

In a worst case scenario, banks that fail in the EU, under the proposed laws that take effect this year, mean that over a million savers could be stiffed.

Your Money Becomes The Bank’s

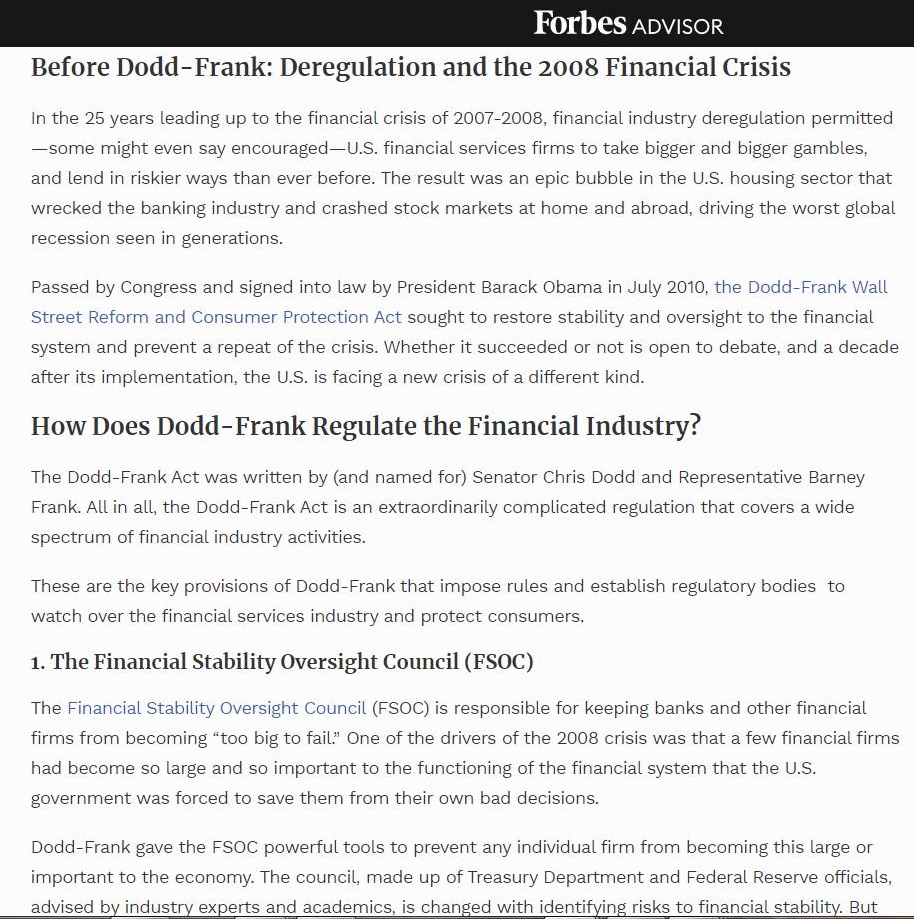

Don’t like banks? The government doesn’t like you. If they catch you with large sums, they can take your savings, too.

.

The Government Can Take Your Money for No Reason

.

Had enough? But wait—there’s more…

Martin Armstrong of Armstrong Economics answers a reader’s questions here:

.

.

It appears we will not be able to escape the carnage as the world’s 8,000 elite dictate we can no longer use physical currency. We will be forced to place our funds in the wolves’ den—Banks or worse still—what big tech has in store for us…

But this is not about cash—this is about controlling your cash.

Remember what I said about the virus?

This is not about a virus—it’s about control

Yes everything you’re experiencing now is about controlling your lives, your body, and your income.

Welcome to Slavery

*******************************************************************************************************

So there it is—or was—the article I wrote last year. Here is the video I stumbled across yesterday:

https://www.bitchute.com/video/LGxWvycgzTVW/">2021 MAY 31 BANK OF IRELAND BAIL-IN KICK OFF 06 AUG; GOING TO SEIZE YOUR MONEY TO BAIL-OUT BANKS

https://www.bitchute.com/video/LGxWvycgzTVW/

![The decision in Foley set to rest the ambiguous dea that the relationship between

bank and customer 15 one of agent and principal According to Smart, the fiduciary

obligation was regarded a loo ongrous a burden for the bank and its business as

it would have placed a continuous responsibility on the baak to account for its

decmions * The principle also highlights the high degree of discretion the bank

has with (he way it cn usc other people's money The obligation on the bank to

For a detailed analysis of the duty to creditors see Keay. A (2003) ‘Directors taking

nto ac nt creditors’ nlerests’, Company Lawyer, val 24, 300. Keay, A (2001)

“The director's duty 10 take into account the mterests of company creditors: When 1s

i wiggered™ Melbourne University Lars Review, vol. 29. 31S, Prestce. D D (1990)

“Creditors” mtcrests and directors” duties”, Oxford Journal of Legal Studies. vol 10,265

Sappdeen, R (1991) Fiductary obligations to corporate <red toes’, Journal of Business

Law, July, 365

6 Space investments 11d v Canadian Imperial Bank of Commerce Trust Co (Bahamas,

£14 and others [1386] | WLR 1072 Lord Templeman “If the bank becomes imolvent

the customer czn only prave in tae Iiquidanoa of the bark as unsecured creditor for the

amourt which was, of ough to have been, credited to the account at the date when the

bank west 10 hquidatoa’, stp 1074

17 Fdward Thomas Foicy © Thomas Mul [1848] 11 HLC 1002

Xb app 1005-000

a man, PE (1990) Leading Cases in the Law of Banking. London, Sweet and Mauwell,](https://contents.bebee.com/users/id/12949473/article/how-usa-s-dodd-frank-ael7X9AmrVaT/osgfz.jpeg)

4CM DISCLAIMER: in publishing this DOES NOT MEAN 4CM is VERIFYING the VERACITY OF THE CONTENT. We are just making you aware of Data. That has been Dropped on the net. to enable facilitate healthy investigations of the truth, which our reader/viewers maybe pursuing

OUR RESEARCH TODAY FOUND THESE INDICATORS:

EDITORIAL: 2021 MAY 08 Bank of Ireland paves way for negative rates on accounts with over €1m: Bank to contact personal customers affected but vast majority unaffected by policy change.

By IRISH TIMES Joe Brennan URL: Sat, May 8, 2021, 07:01

.

![CREDIT WRITEDOWNS

[row] (Fevarmwraveriv Tones]

On Claims Of Depositors, Subordinated And Creditors And Central

Banks In Bank Resolutions

I Vm mrb, Cn £9. 2000](https://contents.bebee.com/users/id/12949473/article/how-usa-s-dodd-frank-ael7X9AmrVaT/JB9Uo.jpeg)

![The meni urs ois ome ve yea expense WS cose yo or oh wth Bs Bt yas ant cx yous mets

herria

Depositor preference rule

50. the heat Ere | wou er 10 addr rss Ur Sebati snd Uae introduc ion of 4

urgesniton preter ence rue in insolvency. As you kfiow, 3 Srpositor preteen be Frgu es

That in thr insobemncy of bank the das of Geponiton enoy 4 pr vleged statis The

ower Form Of depot pr olection, an it eHecTivdy Pinder the assets of the bank for ther

ret Of Beonitons, 10 (Lr Lo be hespret that the exnZimnce oa Gegositor preference tube

Fruit risk of Bank rm

Amasority of G; 70 cunts ins bare some for m of egenitor prefs ence role, inchading

Antal Sree 146s 30 the Unie Statins The egaitor ede rece ute Fos 1 sd sonally

Der rs ommionn § U Membres SLatis. Hesse, a fr surg mimbes of § ur open

counties vehach have Geet gone. 06 at unde goeng. § UNM programmes, inc king Greece.

Portugal, Hungary, Lats and Roman, have ints uc drositor preter nce regime

Beyond the § LIME proms mime countries, te Vicker s (ror! advo ates the ints ocr tion of

adbeponitor peter ene ube in the UK, whach would preder res] dnpositons og to the hat ©

the deposit paar antree scheme

The ech tanking of the Gepost claim varies in thous counts irs which Rave adopted a

Cipro preter nor fue In most jue sdk tom, inching most frkevant § U Member States,

the gos 2 Lams. anh babies sev rec) Les ac Oth pe efor Clare, 30h Lae ae

enpyre Compensation cLimerr, and ahi of Th: cams of gre al Luc Cito,

Howry, if the US. among uuu 1 1 oditors, the dams of the imobancy admits ator

Fark fst, and The Segoniton rank ahead of fax and pmgloyse: somprmation claims. Gerren,

Pars ahi created 3 supe 9108 <a for Grpontons, which tank ahead of Lax and other

tate Clams, and andy beds the Rank of Greece of any otter fran ual collate al hoe

Bank emghoyees hue priority over Srgositon for part of thse calms to te deter mane a

hoc by a inestorial dec raon As | under Land i, secured 2 eblors seem 10 fotain thes:

peetreential fank on the spec smset charged, hmted howe 10 7/3 of the set's met

valor uns Lepusdation.

rropces, such ana bmi

Moat countries imgose some ermtations on tes: depoutor pe

akin 26 The sa ante: Brit nce The Seproul Gua anton sc heme. a 10 the Case

Furpran mime, including the Geek and Portugure kesislation.

The sete action of a degen 20 pref nce rule with the Spout peasants scheme varies

om ut fi ton 0 ur cic thon,

Senne Hal Lrrabuan Avsrtant General Come Lnga Serve on 8 us open Central Bank 1 U webnate](https://contents.bebee.com/users/id/12949473/article/how-usa-s-dodd-frank-ael7X9AmrVaT/QU6y5.jpeg)

More Links below. Now some of you are going to think to yourself ‘some of these articles are old—2013.’ But these things can’t be done overnight. It takes planning and time to put the bricks-and-mortar into place:

H. R. 4173

.

Banking Regulation of UK and US Financial Markets

![When You Weren't Looking, Democrat Bank Stooges Launch Bills to

Permit Bailouts, Deregulate Derivatives

Posted an March 19. 7011 Dy Yves Seth

One of the tig Bowsos of the Raut negotiabon Gees bang cu (or more accusatory, 0) Cypnss's banks

i Grergutating enim WB an FEA OF CAGE State uaranioe 6 3 bac Bn YW Ke glen Pen 3

ICE 10 Gant we Bun (1524S money, and You Can fost Faun al Biry wil renialy Tvs Biedens.

an

In Cyprus. bark egos, which In ory 27 Sons (Mnaning oven yone pe who ves money 1 Be bark

903 wer out bore: they 10% 3 PANTY) ET (ROVING 10 be 101 30 The: 1Ea%an = hal Pen a0 much ied 0 the

wy Of 1guTy Thee penTy TCH 10 sordid Sebl The seer Bec (18 Aner to SRG) I mrly

Screen or Contra Bark det The Gears are imag on privat wecior Gur Galan” whch mar

Score fu Tun Con a Darks ceed 0 Like kn Jough Come of § TAB descend uty he

ofc gorn Gecxied & wars 10 hard 12 GO 30s the non central bark bandos.

AS 115. therm weve ots of Good (RCTS Why 3 S0eenn Godt HBLCANNG Grd no! happen | don wand 10

Boargury here Notably te tact Ta he Dongs Ft eve esd ko AFUKRET wee Quer urd § git

Lie an weer Vaedy Tose] Dy The ond of evesior who's wing Jo Ite |e the probines fee Arcus 1

al was the natity 1 got wri down. 0ut of Cypro Commas bre Sovergn Jett. because But wan hekd by

hw Barks ahah Srmady orm big Sack holm 1° Bis Dulane sheets. AGEN en COTE Up 1 Somat hat

Cou be rar 1 Fae Sefer of The Orpon ivy IOC SIENA war 0 Great eve ater. Tl ary

iron of Kus woe] Pree Deen par | The wiiow Brooulr. STR Te perruon Rnd hoi

Toca vw tors

17 the US. depostan furve achat Benn ul in 3 worse oulon tian Cyprus depout holders. 3 bes try

0 3 Tw bag Darks 1 play 0 Fae Serheaties CED Th QUO Fup rma 3 DIN (ye 5 Darks Gu

Phe Ser 10 ned anaes mposuee. AS a3 bad 5 That. The Onponons, une thee Cypriot

Contes. an even sere cretion. Kemet Lefer Whee Bu evestrend bark Lied, umecund

mStons ane] reeweTone. SepONns are urecued Gas) gol exh cents on Fue oka One tag fron was

a Greate Cou Tare (gu CLs Kor 3 ETPORAT. THN tery 0 vecund Gears The

200% BAPADACY TESTS, THI (NT VARY CPA Serr 10 Leu iors | efeman fad arty feo.

7) 10 baring subsaanes, anc 1 my Rowe, ws nt ahenng otal argos ut as eras may

FC. hark of Aria raves mist of 2% desteathees orm Bs Mest | mc oper tion i Grgoulary in Lite 7011

As irre pcre

Fark of America Corp (AC). at by 2 rect Sowngrade List mani. hs famed Onevalers Tor 25 Merrll.

LYNCH ud 10.4 wtrakary Buh wh sarod Gross, 3<0nIng 1 pep wih Sect Knowinsge of Bie

smuton

Fark Of America's hong Company Bae parent of both Hie tal bark nd Bie Meer Lynch secu und

ei aon §7% Wr of Gneevaers 31 ta ved of June. 30rd 1 ata Corie by Te OCC Aboud

$51 5on or 71 paver. wher when Bank of Arnica NA 2<0rng 10 Far ata. whch freee te

notional ae of te Eades

Ar Bark of Armes hardly unaue Hoomeeg agen

Th Compare wih SIMOran (pon Lakin endl 5 Morgan Crise flank NA which contaned #1

ceed Of ta: New Yorh Gane frre's $75 lon of notional dnevafives, he OCC Gata sow

As wr wet of te tre](https://contents.bebee.com/users/id/12949473/article/how-usa-s-dodd-frank-ael7X9AmrVaT/K52sp.jpeg)

.

On Claims Of Depositors, Subordinated And Creditors And Central Banks In Bank Resolutions

.

Resolving Globally Active, Systemically Important, Financial Institutions

.

.

.

Default DHS writes to Banks: May inspect safe deposit boxes & seize contents w/ no warrants

.

Copyright Disclaimer Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use.

in Truth

Articles from Joyce 🐝 Bowen Brand Ambassador @ beBee

View blog

As an investigative journalist, you hear about things—and things—and things… · Many of them are hard ...

I have a story to tell. · We all do. · I sought to live a life of obscurity. · I’ve always downplaye ...

L'holocauste ne s'est jamais terminé. Il n'était pas silencieux. Vous avez ignoré nos cris. · Je sai ...

You may be interested in these jobs

-

Estimator

Found in: One Red Cent US C2 - 2 days ago

Kimmel & Associates Middlesex County, United StatesAbout the Company: · For over 100 years, our client has established an unmatched reputation for professionalism. They take great pride in delivering highly technical mechanical systems on time and within budget. Today, they are responsible for designing and installing advanced me ...

-

Yard Associate

Found in: One Red Cent US C2 - 1 week ago

Sunbelt Rentals, Inc. Houston, United StatesJoin Our Team · Sunbelt Rentals strives to be the customer's first choice in the equipment rental industry. From pumps to scaffolding to general construction tools, we aim to be the only call needed to outfit a job site with the proper equipment. Not only do we offer a vast fleet ...

-

Area Assistant Kitchen Manager

Found in: Lensa US Remote C2 - 5 days ago

Marcus Corporation United States Remote jobJob Description Area Assistant Kitchen Manager - MKE Market **Your Future Responsibilities** : * Oversee and supervises daily line operation; · Responsible for overall preparation all food items for banquet and restaurant use according to standard recipes; · Visually inspects a ...

Comments