How Dodd-Frank Was Changed to Steal Your Money

.

Dodd-Frank was put into force after the 2007/2008 banking crisis. The original intent was to keep banks from becoming too big to fail. [Many of us can see how well that worked—I mean the big part…]

The article below gives you some history, but it doesn’t tell the whole story.

How The Dodd-Frank Act Protects Your Money

As with many laws, industry pokes and pokes our legislators to tweak laws to benefit them. Government has thrown off the robes of responsibility and thrown us to the wolves once again.

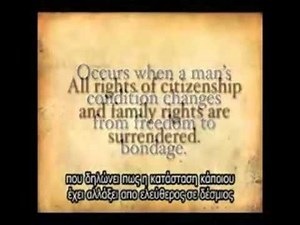

Dodd-Frank has been changed to provide for “Bail-ins” rather than “Bail-outs.” What that means is that when you, the bread-winner, deposit your hard-earned cash or paycheck in a bank, it no longer belongs to you. You become the unsecured creditor and the bank now owns your income.

.

See the article below:

It Can Happen Here: The Confiscation Scheme Planned for US and UK Depositors

“Ellen Brown, Contributor

[Ellen Brown is an attorney, Founder of the Public Banking Institute, and author of twelve books including the best-selling Web of Debt.]

04/03/2013 11:11 am ET Updated Jun 03, 2013

Confiscating the customer deposits in Cyprus banks, it seems, was not a one-off, desperate idea of a few eurozone troika officials scrambling to salvage their balance sheets. A joint paper by the U.S. Federal Deposit Insurance Corporation (FDIC) and the Bank of England dated December 10, 2012, shows that these plans have been long in the making; that they originated with the G20 Financial Stability Board in Basel, Switzerland (discussed earlier here); and that the result will be to deliver clear title to the banks of depositor funds. New Zealand has a similar directive, discussed earlier here.

Few depositors realize that legally, the bank owns the depositor’s funds as soon as they are put in the bank. Our money becomes the bank’s, and we become unsecured creditors holding IOUs. (See here and here.) But until now, the bank has been obligated to pay the money back as cash on demand. Under the FDIC-BOE plan, our IOUs will be converted into “bank equity.” The bank will get the money and we will get stock in the bank. With any luck we may be able to sell the stock to someone else, but when and at what price? Most people keep a deposit account so they can have ready cash to pay the bills.”

Wages have plummeted in past decades. It’s hard for many to make ends meet. Just imagine going for groceries to feed your kids and having your card declined so a bank you trusted can try to save itself from its bad decisions.

.

Too Big To Fail Banks Can Keep Your Money If They Fail

Michael Lazar, Contributor

[Contributor, NowItCounts.com The Destination For Americans 50+]

03/25/2016 10:13 am ET Updated Dec 06, 2017

Can too big to fail banks really take your money if things go sour and leave you screwed without access to your cash?

The short answer: without the proper regulation in place (which is currently not in place), is: YES.

A bank rescue scheme that led to one man killing himself after losing over $100,000 is already testament to it. In his suicide note, the man explained that after being a customer of the bank for 50 years, and investing in bank-issued bonds, he was relieved of his investments thanks to a hidden clause that saw him and 130,000 shareholders and bondholders left hung out to dry so the bank could stay afloat.

The bank in question was already in rescue mode, and in order to tap into a specially created rescue fund, it had to meet the requirements of the wealthier banks that would be providing the funds. However, before these funds can be accessed, the bonds are first tapped, at the loss of any said bond or shareholder.

BBC explained this method as a “bail-in.” In plain English, that means that bondholders got screwed because the bank they trusted failed. Newer EU laws basically say that losses must be forced on bondholders and depositors who have more than €100,000 on tap.

In a worst case scenario, banks that fail in the EU, under the proposed laws that take effect this year, mean that over a million savers could be stiffed.

Your Money Becomes The Bank’s“

.

Don’t like banks? The government doesn’t like you. If they catch you with large sums, they can take your savings, too.

The Government Can Take Your Cash for No Reason

Had enough? But wait—there’s more…

Martin Armstrong of Armstrong Economics answers a reader’s questions here:

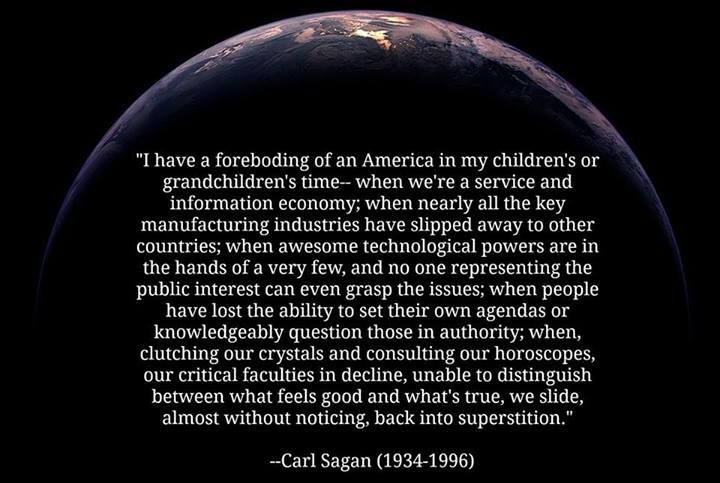

Digital Dollar & Civil War

It appears we will not be able to escape the carnage as the world’s 8,000 or so elite [matter of opinion] dictate we can no longer use physical currency. We will be forced to place our funds in the wolves’ den—Banks or worse still—what big tech has in store for us…

.

But this is not about cash—it’s about controlling your cash.

Remember what I said about the virus?

This is not about a virus—it’s about control

Yes, everything you’re experiencing now is about controlling your lives, your body, and your income.

Welcome to Slavery. It’s just around the corner.

.

Copyright December 2020 by Joyce Bowen

Articles from Joyce 🐝 Bowen Brand Ambassador @ beBee

View blog

First, A disclaimer—by me. · I know some of you will want to hit me. · I was always pro-choice. · I ...

Scary thought, ey? · I’ve been on this planet for nearly 70 years and have watched it being done. · ...

Introduction by Joyce Bowen · There are times you just can’t do it any better than it has already be ...

You may be interested in these jobs

-

Industrial Painter/Prep Person

Found in: Betterteam US S2 T2 - 2 weeks ago

Lehman Industrial Coating Akron, United States Full timeJob Description:You will be asked to be in the booth painting 4-6 hours a day at minimum. · When not painting in booth you will be asked to bee cutting in parts and other prepping activities to get more things ready to paint. · We work with industrial enamel paint and a zinc rich ...

-

Regional CDL-A End Dump Drivers|Careers in gear

Found in: beBee S2 US - 2 weeks ago

Woody Bogler Trucking Castleton, IL, United States Full timeHiring Company End Dump DriversIf you are an experienced end dump driver or if you are an experienced truck driver who would like to learn end dumping we want to talk to you. Come drive a 4 year old or newer Peterbilt 579 geared toward your comfort while on the road. While you ar ...

-

Manufacturing Technician II, Device Assembly

Found in: beBee S2 US - 4 weeks ago

Resilience West Chester, United States Full timeA career at Resilience is more than just a job – it's an opportunity to change the future. · Resilience is a technology-focused biomanufacturing company that's changing the way medicine is made. We're building a sustainable network of high-tech, end-to-end manufacturing solution ...

Comments