“CX, CI, EE, oh my!”

Gotta love acronyms. Corporations can’t seem to stay away from these shorthand communications devices. I once tried to convince a client not to shorten their Continuous Improvement initiative to CI. “It trivializes the concept,” I said. I lost the argument. So for the sake of clarity:

CX is Customer Experience. CI Is Continuous Improvement. EE is Employee Engagement. These three concepts are not only related; they are inextricably intertwined

“CX, CI, EE, oh my!” is what a friend suggested as a title for a talk about at a Customer Experience in Financial Services conference, a reference to the Wizard of Oz scene where Dorothy, the Tin Man, and the Scarecrow tiptoe through the forest worrying that they’ll meet “Lions, and Tigers, and Bears, oh my!” I was “invited” to purchase a booth at this CX conference for thousands of dollars for in exchange for a 20 minute speaking slot. I declined this “opportunity,” but a little quick Internet research showed me that there are about 10 such conferences this fall.

It seems that the Financial Services industry has suddenly become aware that they are fast becoming victims of their own digital transformation. Wikipedia tells me that the first Automatic Teller Machine (ATM) was introduced at a Barclays Bank in North London in 1967. I remember ATMs catching on in the UK during my second year at the London Business School in 1980.

When I returned to the US then Citibank Retail Bank CEO, John Reed, was crowing in the business press about how they were “taking the headcount out of the transaction. Soon you will have to pay a fee to talk with a teller.” That particular outburst was met with such outrage, that Reed later walked it back, but fees have since turned banking into a much more profitable business and ATMs are ubiquitous.

Continuing along the path of “taking the headcount out of the transaction,” banks have instituted, “pay-by-phone,” “pay-on-line,” entire on-line banking, and now “mobile-pay,” invented by military auto insurer USAA and copied immediately by every other financial institution, where you take a picture of both sides of a check and text it and it is credited to your account.

Now everyone banks on-line, (except the latest of adopters like me) shops Esurance, or Healthcare.com and gets mortgage quotes from Lending tree and Quicken loans. And that is to say nothing of electronic currencies like Bitcoin, Blockchain ledger technology to support these payments, or “chat-bots,” artificial intelligence (AI) to “talk” with customers.

Now it seems that Financial Services companies are struggling to have a Customer Experience (CX) that will differentiate their business, while managing to have absolute security and absolute convenience simultaneously – a daunting challenge. And all this without talking to a real person.

CX or “Focus on the customer,” as Peters and Waterman called it, isn’t a new concept. I worked on the privatization of British Airways, 1984-87. Mrs. Thatcher challenged BA to go from having the world’s worst customer service to best in in three years. Miraculously they did it, through employee engagement driven continuous improvement projects. For example,

- Customers hated the lines at Heathrow; BA created “queue combers,” people who went through the lines and resolved questions and expedited those with connections.

- Delays were caused by Heathrow’s frequent fog; BA created a “fog protocol” an abnormal conditions process to reroute connections.

An oil company executive closed his company’s Toronto Dominion Bank accounts because of “your appalling customer service.” I worked on a team which helped TD branch managers and their staffs get to know their customers and what they wanted. TD simplified deposit and withdrawal processes and found ways to make customers feel special.

I have done this kind of CX/CI/EE in numerous manufacturing and service businesses including diversified financial services. It always starts with the CX part, but with liberal use of EE.

One activity that has big impact is to have leaders and staff “experience the company as customers, under-cover,” without identifying themselves. I have sent people to interview customers and advocate for their point of view in a group session. Understanding real customers’ experience is always very powerful.

Combining CX with CI can be tricky. My Results-Alliance colleague, Ric Taylor and I have developed CI training that is a combination of hard and soft skills that works really well. We are transitioning from a three year Lean Six Sigma engagement, turning over to internal trainers. During this work we have noticed that process people gravitate to an internal view. We’ve noticed that Black Belt candidates jump over the “customer house” in the Houses of Quality or Quality Function Deployment (QFD). These groups also struggle with a process mapping facilitation, where the task is to map the experience on one customer in order to offer improvement advice to the provider. They get caught up between as-designed and as-is and miss “as-experienced.” Getting this right is critical; otherwise you engage all employees (EE) at internal focus and the customer gets left behind.

I recently read The Revenge of Analogue, by David Sax, who tells the story of the resurgence of vinyl LP records, Moleskine notebooks, and independent bookstores. (As the original “late adopter” of digital technology, I loved this book.) Sax’s premise is that we crave a “real experience,” real things that you can hold, that are delivered by real people. We don’t all want that all the time, nor are we always willing to give up speed, convenience and cheap price. Even I, the original late adopter, buy from Amazon most of the time and only occasionally go to my local independent bookstore.

So this leaves open the question of Digital Customer Experience (DCX?). How do we get into the mind of a customer, when our only interaction is clicks? Amazon once thought the way was recommendations for more of what you just bought, but now seems to have decided maybe retail isn’t such a bad idea. Perhaps they will learn that big data isn’t enough. Real people are more complex than algorithms.

Many ecommerce sites seem to have gone with personalization, My Ebay. Make it easier, faster or quirkier, as you desire.

Or you could just ask. Certainly the entire on-line commerce industry is over-using surveys to the point where I wonder if anyone ever looks at the data. Or you can use “community” either through social media like LinkedIn, Facebook and Instagram or real community – the way that Patagonia connects on environmental issues or Toms shoes, which gives one pair charitably for each pair bought.

But it takes understanding the minds of customers – we aren’t all alike - understanding what customers want to experience and what they do experience (CX). If there is a gap then you can improve (CI) and engage all employees (EE) to deliver it.

"

Articles from Alan Culler

View blog

https://www.freeimages.com/photo/candles-1161780 @korionovThe cold sun sets earlier and rises later ...

“‘I need your help,’ the blond whispered in my ear as she took me by the arm and started fast-walkin ...

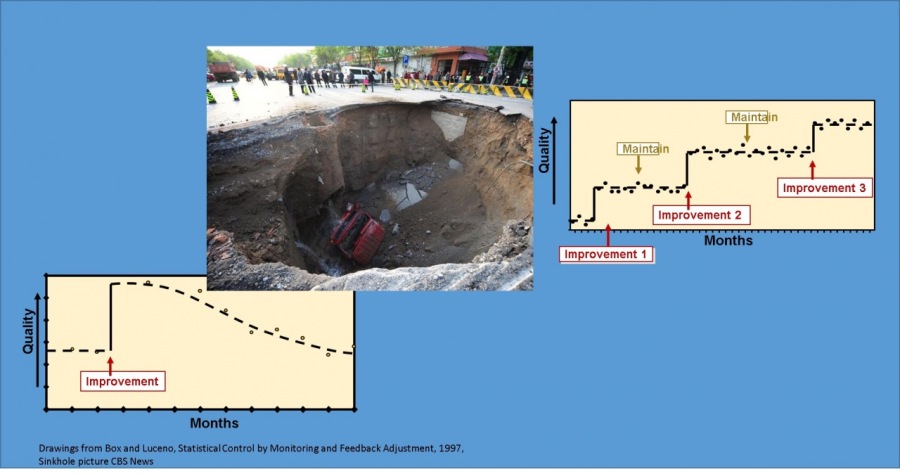

Continuous Improvement (CI) is a discipline that has been around in the United States (at least) sin ...

Related professionals

You may be interested in these jobs

-

Safety Manager

Found in: Appcast US C2 - 1 day ago

Faulconer Construction Roanoke, United StatesFaulconer Construction Company is in search of a dedicated Safety Manager for our Roanoked, VA area. The candidate will be under the direction of the Regional Safety Manager assisting in the safety, health, and welfare of our employees. Qualified candidates must be willing and ab ...

-

Accreditation Operations Intern

Found in: beBee S2 US - 4 weeks ago

Accreditation Association for Ambulatory Health Care Deerfield, United States InternshipAbout us: · AAAHC advocates for the provision of high-quality health care through the development and adoption of nationally recognized standards. We provide a valuable survey experience founded on a peer-based, educational approach to onsite review. The AAAHC Certificate of Accr ...

-

Registered Nursing Case Manager

Found in: Jooble US O C2 - 3 days ago

Res-Care, Inc Temple, TX, United StatesRegistered Nurse Case Manager - Hospice · Embrace Hospice · Our Hospice Registered Nurse (RN) Case Managers are the heart of our organization In this role, you will support your patients by providing direct care and coordinating with the interdisciplinary team to ensure that bot ...

Comments

Lance 🐝 Scoular

6 years ago #7

Alan Culler Using the emojis on my Samsung S8 👥ed = shared 👥ing = sharing 🐝🐝= beBee 🐤 = Twitter 🐳 = LinkedIn 🔥 = blast, via my designated Twitter Network of handles all at the same time. 🚲 = cycle, a growing curated list of beBee Producer articles and other articles related to beBee (currently about 460+) rotated through my network randomly over a 2 to 3 week period.

Alan Culler

6 years ago #6

thanks Bill for commenting I gather all the emoji -or as my granddaughter calls the stickies are positive. Glad you liked it

Alan Culler

6 years ago #5

as a very late adopter the emoji are somewhat untranslatable to me I got the shared on beBee ( thanks) but not the rest.

Alan Culler

6 years ago #4

for you comments, Lance \ud83d\udc1d Scoular I will look up Small Data

Bill Stankiewicz

6 years ago #3

Lance 🐝 Scoular

6 years ago #2

Lance 🐝 Scoular

6 years ago #1